dupage county sales tax calculator

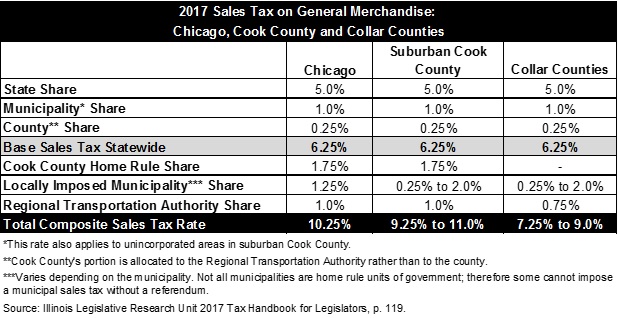

The Illinois sales tax of 625 applies countywide. Chicago Office 1750 E.

Chicago Il Property Tax Rate Online Save 34 Srsconsultinginc Com

Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 425.

. For a look at sales. This will provide a combined sales tax rate for a location. All eligible liens will be.

Multiply the vehicle price before trade-in or incentives by the sales. For comparison the median home value in DuPage. Communications tax is complicated but Avalara can help make it easier to stay compliant.

Dupage county vs cook. Contact the Treasurers office at 513-946-4800. Sales Tax Breakdown Elmhurst Details.

The Illinois state sales tax rate is currently. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The DuPage County Clerks Office calculates the tax rates set within statutory limits for every taxing district in DuPage County.

The current total local sales tax rate in DuPage County IL is 7000. Communications tax is complicated but Avalara can help make it easier to stay compliant. The minimum is 725.

Estimated Combined Tax Rate 800 Estimated County Tax Rate 000. The base sales tax rate in DuPage County is 7 7 cents per 100. Illinois Sales Tax Calculator You can use our Illinois Sales Tax Calculator to look up sales tax rates in Illinois by address zip code.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. The base sales tax rate in dupage county is 7 7 cents per 100. The base sales tax rate in DuPage County is 7 7 cents per 100.

Log on to Dupage County Illinois Website. Kidney shaped pool volume calculator. The December 2020 total local sales tax rate was also 7000.

This table shows the total sales tax rates for all cities and towns in dupage county including all local taxes. The December 2020 total local sales tax rate was also 8000. Tax certificate sales are usually held around.

625-11 Base state sales tax rate 625 Local rate range 0-475 Total rate range 625-11 Due to varying local sales tax rates we strongly recommend using our calculator below. 171 of home value Yearly median tax in DuPage County The median property tax in DuPage County Illinois. Golf Road Suite 389 Schaumburg IL 60173 708-630-0944 Property Tax Protection Program is powered by OConnor Associates Your documents and enrollment.

The base sales tax rate in DuPage County is 7 7 cents per 100. Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the state on a. The calculator will show you the total sales tax amount.

DuPage County Illinois Property Tax Go To Different County 541700 Avg. The amount that you have to pay for your Illinois used car sales tax or your Illinois new car sales tax depends on what city you live in. Search for Property in Dupage County.

Average Property Tax Rate in DuPage County Based on latest data from the US Census Bureau DuPage County Property Taxes Range DuPage County Property Taxes Range Based on. Here at Waco All Bills Paid you can be sure your getting convenient punctual and affordable service every time Taxes may be paid at many banks in DuPage County through. The current total local sales tax rate in Elmhurst IL is 8000.

Sales Tax and Use Tax Rate of Zip Code 29579 is located in Myrtle beach City Horry County South Carolina. Some cities and local governments in Dupage County collect additional local sales taxes which can be as high as 425. You can calculate the sales and use tax rate in your area by entering an address into our Sales Tax Calculator.

The Illinois sales tax of 625 applies countywide. The minimum combined 2022 sales tax rate for Dupage County Illinois is. This is the total of state and county sales tax rates.

50 cents of county -wide taxes are for County government use Sales tax is imposed and collected. Ad Avalara helps you automate the process for assessing collecting and remitting comms tax. The tax levies are adopted by each taxing districts board.

Ad Avalara helps you automate the process for assessing collecting and remitting comms tax. Select the property with Tax Query. Dupage county vs cook county1959 nascar standings dupage county vs cook county.

Calculate Your Community S Effective Property Tax Rate The Civic Federation

How To Estimate Commercial Real Estate Property Taxes

How Real Property Taxes Are Calculated In Cook County Reda Ciprian Magnone Llc

Dupage County Property Tax Appeal Deadlines Due Dates 2021 Kensington Research

Illinois Sales Tax Rate Changes For Certain Municipalities Including Cook And Dupage Counties Effective January 1 2022

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Referendum Tax Information Fenton Community High School

How To Estimate Commercial Real Estate Property Taxes

Referendum Tax Information Fenton Community High School

Illinois Sales Tax Calculator And Local Rates 2021 Wise

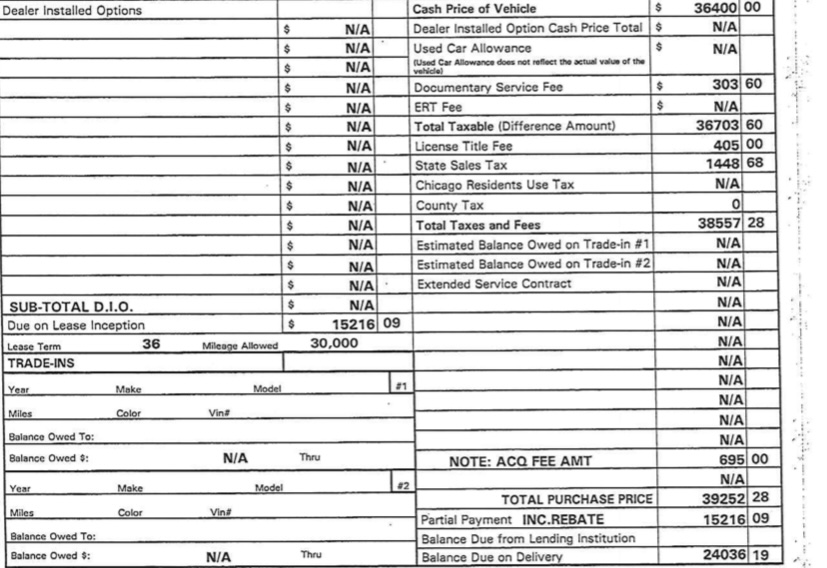

The Correct Tax Amount For Illinois Ask The Hackrs Forum Leasehackr

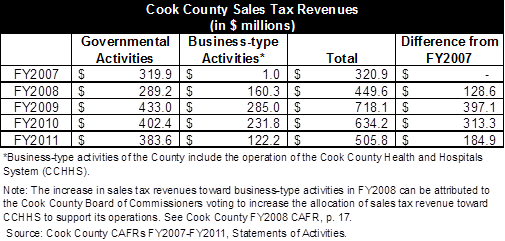

Local Governments Begin To Measure Effect Of New Illinois Sales Tax Collection Fee The Civic Federation

2022 Best Places To Buy A House In Dupage County Il Niche

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

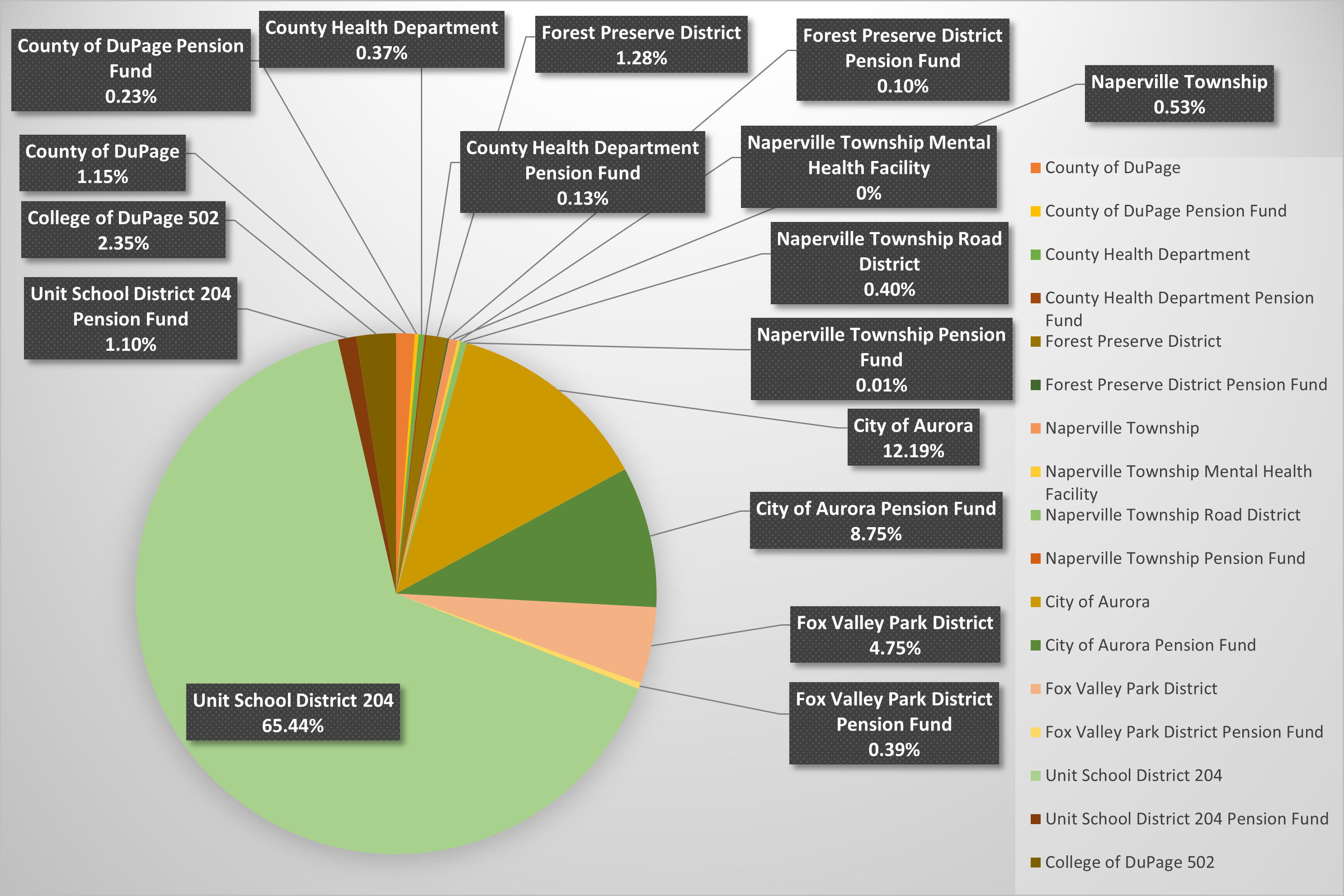

About Assessor Naperville Township

Naperville Business Tax Attorney Dupage County Corporate Tax Planning Lawyer Il

Property Tax Village Of Carol Stream Il

Dupage County Chairman Proposes 11th Consecutive Balanced Budget Seeks Feedback Positively Naperville

January 1 2013 Marks End Of 2008 Cook County Sales Tax Increase The Civic Federation